Some Important Concepts to Understand the Riba

Muhammad Abubakar Siddique,

Lecturer, Int’l Institute of Islamic Economics (IIIE),

Int’l Islamic University, Islamabad.

Website: https://islamicfina.com/

………………………………………………………………………….

………………………………………………………………………………..

What is Riba:

According to Islamic Jurists except Ibn al-Qayyim, all are of the view that

any stipulated additional amount/quantity over and above the principle liability (debt/dayn/دین) whether it is emerged from loan or sale.

………………………………………………………………………………………………………………………………………………

Some Important Concepts:

There are some important pre-requisite concepts which are necessary to understand the true concept of riba.

What is the difference between Debt and Loan?

Debt: Any liability that is generate as a result of any action caused by human is called debt. For example,

1. IF Mr. A brakes the asset (worth Rs. 200) of Mr. B, then Mr. A will become liable to pay the price of Rs. 200 to Mr. B. The liability of Rs. 200 has been generated as result of Mr. A’s action. That price has become debt upon Mr. A for Mr. B.

2. Mr. Zaid bought something on credit from Mr. Bakar against Rs. 3000 that are payable after one month. These Rs. 3000 will be considered as debt upon Mr. Zaid as it has been generated as a result of purchase activity committed by Zaid.

Loan: Borrowing of asset (cash/goods) is known as loan (قرض).

Borrowing is an action caused by human that is why it generates liability (debt). Hence, Loan becomes debt.

Principle: Every loan becomes debt, but not every debt is caused by loan.

Conclusion: Both Debt and Loan will be dealt likely while applying the principles of riba.

…………………………………………………………………………………………………………………………………..

Commutative contracts (عقود المعاوضات) and Gratuitous contracts (عقود التبرعات)

Commutative contracts (عقود المعاوضات) are the contracts contains exchange of counter values from both the contracting parties such as contract of sale, ijarah (lease), Salam sale, etc.

Gratuitous contracts (عقود التبرعات) are the contracts with the feature of donation of property. The doner transfer ownership of that property to a party without consideration like hibah (gift), wasiyyah (bequest), waqf (endowment) etc.

………………………………………………………………………………………………………………………………………..

Sale and Loan (بیع و قرض)

What is Sale?

In Islamic jurisprudence, Sale is defined as follows;

الْبَيْعُ مُبَادَلَةُ الْمَالِ بِالْمَالِ بِالتَّرَاضِي

Sale is exchange of property for property with the mutual consent of parties.

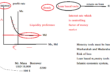

There are following possibilities of Sale with respect to nature of property;

1. Barter sale (Goods Vs. Goods): There are following two possibilities for barter sale

- Gold Vs. Gold, Silver Vs. Silver, Gold Vs. Silver, Currency Vs. Currency – When items of exchange are money it is known as Bay Saraf (بیع الصرف).

- Wheat Vs. Wheat, Barley Vs. Salt etc. When items of exchange are non-monetary items. It depends upon the parties which goods they consider as price and which goods they consider as subject matter (mabee مبیع).

2. Normal Sale: Gold/Silver/Currency Vs. Wheat/Barley/Salt/Dates – It is called normal sale. Here monetary items will be necessarily considered as price and other items will be regarded as Mabee (subject matter).

Conclusion: Exchange of property for property is known as sale. Hence, Sale is a commutative Contract (عقد معاوضه).

What is Loan?

We have already defined loan. However, here it is not required to define it. The purpose of the question is whether loan is different from sale or it is a sale contract?

According to Hanafi jurists,

إن القرض من عقود التبرعات و إنه تبرع في الابتداء ومعاوضة في الانتهاء

Loan is gratuitous contract (عقد تبرع) in the beginning as lender does not receive any counter-value against lent amount, whereas it becomes commutative contract (عقد معاوضه) as lender receive counter-value at the maturity date.

Now it would be easy to understand the concept of Riba (interest) – Click here