What is Money Market?

The money market is where financial instruments with high liquidity and very short maturities are traded. It is used by participants as a means for borrowing and lending in the short term, with maturities that usually range from overnight to just under a year. Among the most common money market instruments are Eurodollar deposits, negotiable certificates of deposit (CDs), bankers acceptances, U.S. Treasury bills, commercial paper, federal funds and repurchase agreements (repos).

Money market Instruments:

Here only three major instruments are being defined

1. Discount Instruments:

These instruments don’t pay interest as such. They are issued at a discount, which effectively means the “interest” is all at the beginning. Think of it from the lenders viewpoint. They wish to lend $100, but actually only need to lend $80 (discounted at the start) but are paid back the full $100.

- Treasury Bills (T-bills) are short-term notes issued by the U.S. government. They are issued at a discount to their face value. They come in three different lengths to maturity: 90, 180, and 360 days. The two shorter types are auctioned on a weekly basis, while the annual types are auctioned monthly. T-bills can be purchased directly through the auctions or indirectly through the secondary market.

- Commercial paper: These are unsecured with a typical term of 30days. There are issued by large organizations with good credit ratings – funding their short term investment needs.

- Bankers Acceptance again are issued by companies BUT are guaranteed by a bank. The banks will get a fee for this guarantee – and because the risk is low (for the lender due to the bank guarantee) – the interest the companies offer on these will be low. Again these are offered at a discount however they are negotiable, meaning they can be traded before maturity. These are normally issued by firms who do not have a good enough credit rating to offer commercial paper.

- Return Based Tools are financial instrument that earns interest.

- A certificate of deposit (CD) is a savings certificate with a fixed maturity date, specified fixed interest rateand can be issued in any denomination aside from minimum investment requirements. Or A CD is a receipt for funds deposited in a bank for a specified term and for a set rate.

- A CD restricts access to the funds until the maturity date of the investment. CDs are generally issued by commercial banks.

- A repurchase agreement (repo) is a form of short-term borrowing for dealers in government securities. The dealer sells the government securities to investors, usually on an overnight basis, and buys them back the following day. For the party selling the security and agreeing to repurchase it in the future, it is a repo; for the party on the other end of the transaction, buying the security and agreeing to sell in the future, it is a reverse repurchase agreement.

- Government Security: A bond (or debt obligation) issued by a government authority, with a promise of repayment upon maturity that is backed by said government. These securities are considered low-risk, since they are backed by the government.

Central Bank’s Requirements from Banks (Conventional and Islamic Banks)

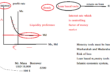

Reserve Requirements: Reserve requirement of banks is to hold liquid assets in the form of cash and, approved securities. SBP requires scheduled banks in Pakistan to maintain two types of reserve requirements, i.e. cash reserve requirement (CRR) and statutory liquidity requirement (SLR).

- Cash reserve requirement (CRR): CRR is the 5 % of banks’ applicable time and demand liabilities (TDLs) that they are required to hold in the form of cash with the SBP on fortnightly average basis. CRR is maintained in current account with the condition of maintain minimum reserve level with the central bank on daily basis. Required level of reserves for a bank in a reserve maintenance period are worked out on the basis of applicable TDLs of that bank at the end of the first day (i.e. Friday) of the maintenance period. Banks are not allowed to carry their excess of reserve position over the next maintenance period. Also, SBP does not remunerate deposits that banks keep with it for meeting the cash reserve requirement.

- Statutory liquidity requirement (SLR): SLR is the 19% for CBs / 14% for IBs liabilities that they are required to invest in approved securities and/or hold in the form of cash; including balances with SBP, with NBP, balances left in the vault of banks, banks’ investment in capital of Micro-Finance Banks (MFBs).

Like CRR, maintaining period for SLR is also fortnightly that starts from Friday and ends at Thursday of the subsequent week. Applicable Time and demand liabilities at the end of the Friday (i.e. the first day of the maintaining period) are taken into account for the determination of SLR to be maintained during the maintaining period (if Friday is a holiday then time and demand liabilities as of close of the preceding working day is taken into account for calculating the SLR.)

Increase in SLR ratio implies that banks are required to hold a larger share of their funds into liquid assets approved/notified by the Federal Government for this purpose. Changes in SLR may change the composition of banks’ assets.