Islamic bank’s Deposit Structure

Muhammad Abubakar Siddique,

Lecturer, Int’l Institute of Islamic Economics (IIIE),

Int’l Islamic University, Islamabad.

Website: https://islamicfina.com/

Oct. 11, 2021

………………………………………………………………………….

………………………………………………………………………………..

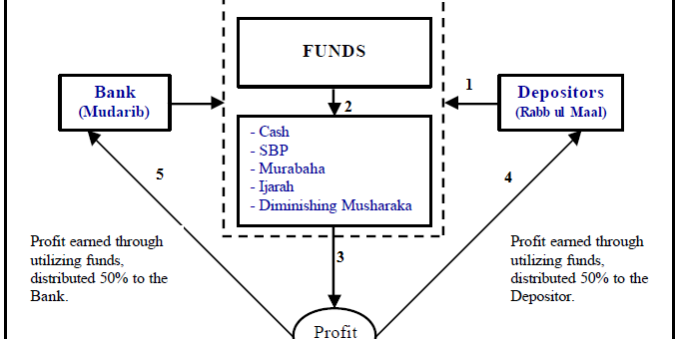

The Structure is based on the principle of Mudarabah and is strictly in conformity with the rules of Shariah Law. It has been approved by the Shariah Supervisory Board of IB. On agreeing to become an account holder, the customer enters into a relationship based on Mudarabah with IB.

Under this relationship, the Islamic Bank is the Manager (Mudarib) of the funds deposited by the

Customers and the Customer is an Investor (Rab ul Mal).

The bank allocates the funds received from the customers to a deposit pool. These funds from the pool are utilized to provide financing to customers under Islamic modes that include, but are not restricted to, Murabaha and Ijarah.

Concept of Pools:

At Islamic bank, the financing assets of the bank are grouped in different Investment Pools with respect to the source of funds. At present the funds & financing assets are allocated to the following Investment Pools:

Types of Investment Pools

- Deposit Pool

- Treasury / Financial Institutions (F.I.) Pool

- Equity Pool

- Specific Customers’ Pools (for Special Musharakah Deposits)

Deposit Pools (Remunerative):

Deposit Pools are made up of funds received from customers in remunerative schemes such as Saving Account, Karobari Munafa Account, Monthly Musharakah Certificate (MMC), Certificate of Islamic Investment (COIIs) etc.

Equity Pool:

The Equity Pool consists of funds from the Bank’s equity. The funds are primarily invested in permissible equities & other permissible Islamic modes. The equity pool may also utilize the funds received from non-remunerative deposits (Current A/C), as these funds are taken under Qarz given to the Bank by depositors.

Specific Customers’ Pools:

Specific Customers’ Pools are made up of funds received from customers under some special arrangement either on Musharakah basis or on Mudarabah basis. The funds from these pools are invested under Islamic modes of finance.

Specific Customers’ Pools are created primarily to give higher return than the general pool return to corporate customers and high net worth individuals, based on Musharakah arrangements.

Financial Institutions Pools:

Funds from financial institution (FI) and SBP can be accepted in these pools under the mode of Musharakah or Mudarabah. At maturity, normally these F.I. Pools are dissolved and assets are transferred back to other investment pools. The F.I. Pools are special purpose investment pools, comprising of financing assets (like Murabaha, Ijarah etc) created to meet the short term liquidity requirements of the bank.

Financial Institutions Pools:

(A). Musharakah based F.I. Pools:

In Musharakah based F.I. Pools, the FI participates in a special F.I. Pool as a ‘Sleeping Partner’ with Islamic bank as ‘Working Partner’. The risk and reward of the pool is shared as per the rules of Musharakah.

(B). Mudarabah based F.I. Pools:

In Mudarabah based F.I. Pools, the FI participates as Rabb-ul-Maal or Investor with Islamic bank as Mudarib or Fund Manager. The risk and reward of the pool is shared as per the rules of Mudarabah.

Pool Fund Utilization (Video Lecture of this Reading)

The deposit general pool can be better understood by looking at the below mentioned demonstration.

At the start:

10 Customers (including Islamic Bank) invest Rs. 100 each. Total deposits stand at Rs.1000. Share of each customer in the General Pool is thus 10%.

Scenario 1:

Now, suppose one customer withdraws his share from the deposit pool; following would be the resulting effects

- The total pool size decreases to Rs.900.

- The share of each of the remaining 09 depositors changes to 11.11%.

- Hence, each partner will now be entitled to a higher profit share.

- The change in the composition of the assets is illustrated below

Scenario 2:

Now, suppose two depositors want to withdraw their share from the pool. This means that Rs.100 needs to be given to each of the depositors. However, the General Pool only has Rs.100 Cash which can be paid. Although, the General Pool has sufficient assets; however, it is short of cash to fund the withdrawal as illustrated below:

In this situation; possible options available for the General Pool for paying another Rs.100 are as follows:

Case # 1: Find new or existing depositors who can bring in that extra Rs.100 in cash

Case # 2: Sell its existing assets to generate Rs.100; this would also decrease the pool size. The

bank can fund invite a Financial Institution (F.I) under the Interbank Musharakah

/Mudarabah arrangement to meet the liquidity needs.

Alternatives:

Case # 1: In this case, the bank is successfully able to attract a new or existing depositor to increase investment; the Deposit Pool would increase by Rs.100 as illustrated below;

This new depositor can be an individual, a firm, a corporate entity or another Financial Institution (FI). Since the depositor is investing in the general pool; he will also be assigned a profit sharing weightage.

Case # 2:

However, in most cases, the bank is not able to quickly generate the needed deposit. Usually, deposit generation is an ongoing campaign and in the face of a high withdrawal, the Deposit Pool may not have sufficient liquid assets to fund the withdrawal which has to be paid to the outgoing depositor immediately. Hence, in most of these cases, Islamic bank as an existing depositor has to increase its investment in the General Pool to fund the withdrawal.

……………………….

نیچے دیے گئے لنک پر کلک کریں اور سبسکرائب کریں ۔

اسلامی معلومات ، روایتی معاشیات ، اسلامی معاشیات اور اسلامی بینکاری سے متعلق یو ٹیوب چینل

https://www.youtube.com/user/wasifkhansb?sub_confirmation=1